Що сталося?

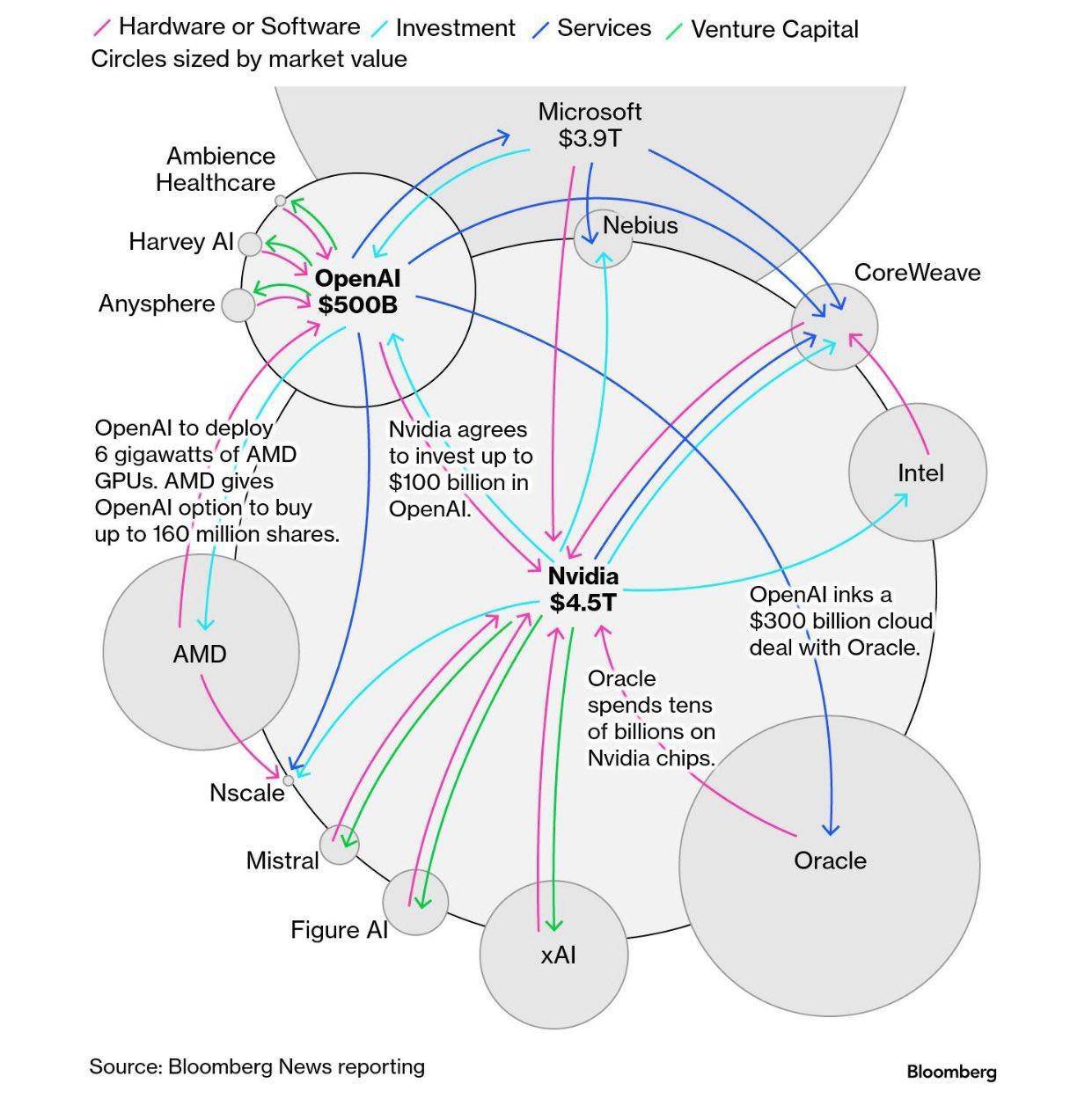

Bloomberg показав схему, де найбільші гравці ШІ одночасно:

— купують одне в одного чипи й хмару;

— інвестують одне в одного або дають опціони;

— підписують гігантські контракти «на роки вперед».

📌 На діаграмі: Nvidia (≈ $4.5T), Microsoft (≈ $3.9T), OpenAI (≈ $500B оцінки), Oracle, AMD, Intel, CoreWeave, xAI, Mistral, Figure AI тощо.

Приклади з самої схеми:

— OpenAI укладає хмарну угоду з Oracle на сотні мільярдів 💭☁️;

— Oracle витрачає десятки мільярдів на чипи Nvidia 💳➡️🖥;

— Nvidia погоджується інвестувати до $100 млрд в OpenAI 🔄;

— OpenAI розгортає 6 гігават потужностей на AMD та отримує опціон викупити до 160 млн акцій AMD ⚡️📈.

У підсумку гроші «крутяться» між тими ж компаніями, оцінки зростають, а ринок захоплює FOMO. Bloomberg порівнює це з іпотечною кризою 2007 року: тоді банки перепаковували кредити, сьогодні стартапи «перепаковують» попит через взаємні угоди. 🤹♂️

Як працює «карусель» на простій мові

Вендер-фінансування: постачальник чипів/хмари інвестує в клієнта, щоб той купував більше саме його продукту.

Довгі контракти: угоди на десятки–сотні мільярдів створюють видимість гарантованого попиту.

Опціони та крос-частки: угоди з акціями підвищують оцінки «на папері».

Маржинальність «на завтра»: сьогодні — великі витрати на інфраструктуру, завтра — сподівання на монетизацію.

Чим це відрізняється від 2007-го — і чим схоже

✅ Є реальні активи: дата-центри, енергія, чипи.

❗️Але є приховані ризики: концентрація на кількох вендорах, офбалансові зобов’язання (довгі хмарні контракти), залежність від дешевої енергії, регуляторні ризики. Якщо реальна віддача ШІ-продуктів запізниться — оцінки можуть «перерахувати». 🧮

Ключові ризики для інвесторів

— Концентрація: значна частина попиту зав’язана на Nvidia; один збій — хвиля по всьому ланцюжку.

— Попит ≠ виручка: експерименти зі ШІ не завжди швидко монетизуються.

— Електрика та охолодження: 6 ГВт — це колосальний апетит енергії ⚡️🧊.

— Переоцінка приватних компаній: вторинної ліквідності мало, дисконти при продажах можливі.

Що дивитися в звітах

— Собівартість 1 тис. токенів/запитів vs. ціна продажу 💵;

— Валова маржа ШІ-функцій;

— Завантаження дата-центрів;

— Капекси на $1 доходу;

— Енергокарта проекту (звідки йде струм і за якою ціною).

Що це значить для України

— Можливості: сервісний експорт (ML-інженерія, MLOps), оборонні застосунки, RAG/LLM-рішення з чітким ROI, локальні дата-центри на ВДЕ (де це безпечно й економічно).

— Обачність: остерігайтесь «GPU-ферм без клієнтів», угод із прихованим вендор-фінансуванням і завищених мультиплікаторів без реальної виручки.

— Де може бути альфа: енергоменеджмент для дата-центрів, системи охолодження, оптимізація інференсу, вузькі галузеві ШІ-продукти (медицина, агро, логістика, безпека).

Що робити інвестору (коротко)

— Перевіряти unit economics кожної ШІ-функції 🧾;

— Питати про енергостратегію і джерело електрики ⚡️;

— Оцінювати залежність від одного вендора;

— Вимагати контракти з реальними клієнтами, а не лише «стратегічні Меморандум&MoU»;

— Бути готовим до переоцінок і secondaries зі знижками.

Позиція в одному рядку: зараз це гігантська ставка на швидку монетизацію ШІ. Якщо доходи встигнуть за капексами — виграють усі. Якщо ні — настане період болючого «перерахунку очікувань». 🎢

Прогнози/сценарії для ринку інвестицій в Україні 🇺🇦

— 🟢 «М’яке охолодження»: глобальні оцінки коригуються, але інфраструктура працює. Для України — стабільний попит на інженерію, зростання оборонного ШІ, більше грантів/EDA.

— 🟠 «Перерахунок через ROI»: корпоративні клієнти ріжуть бюджети на експерименти, down-rounds; в Україні дешевшають активи «заліза», зате підвищується попит на рішення з миттєвим ефектом економії.

— 🔵 «Суперцикл»: продуктивність злітає, монетизація підтверджується; Україна отримує FDI у дата-центри біля ЄС-ринків та продаж українських ШІ-продуктів глобальним вендорам.

Джерело: інфографіка Bloomberg News reporting.