У світі, де криптовалюти та штучний інтелект (ШІ) все більше переплітаються, з’явилася нова яскрава історія успіху. 🚀

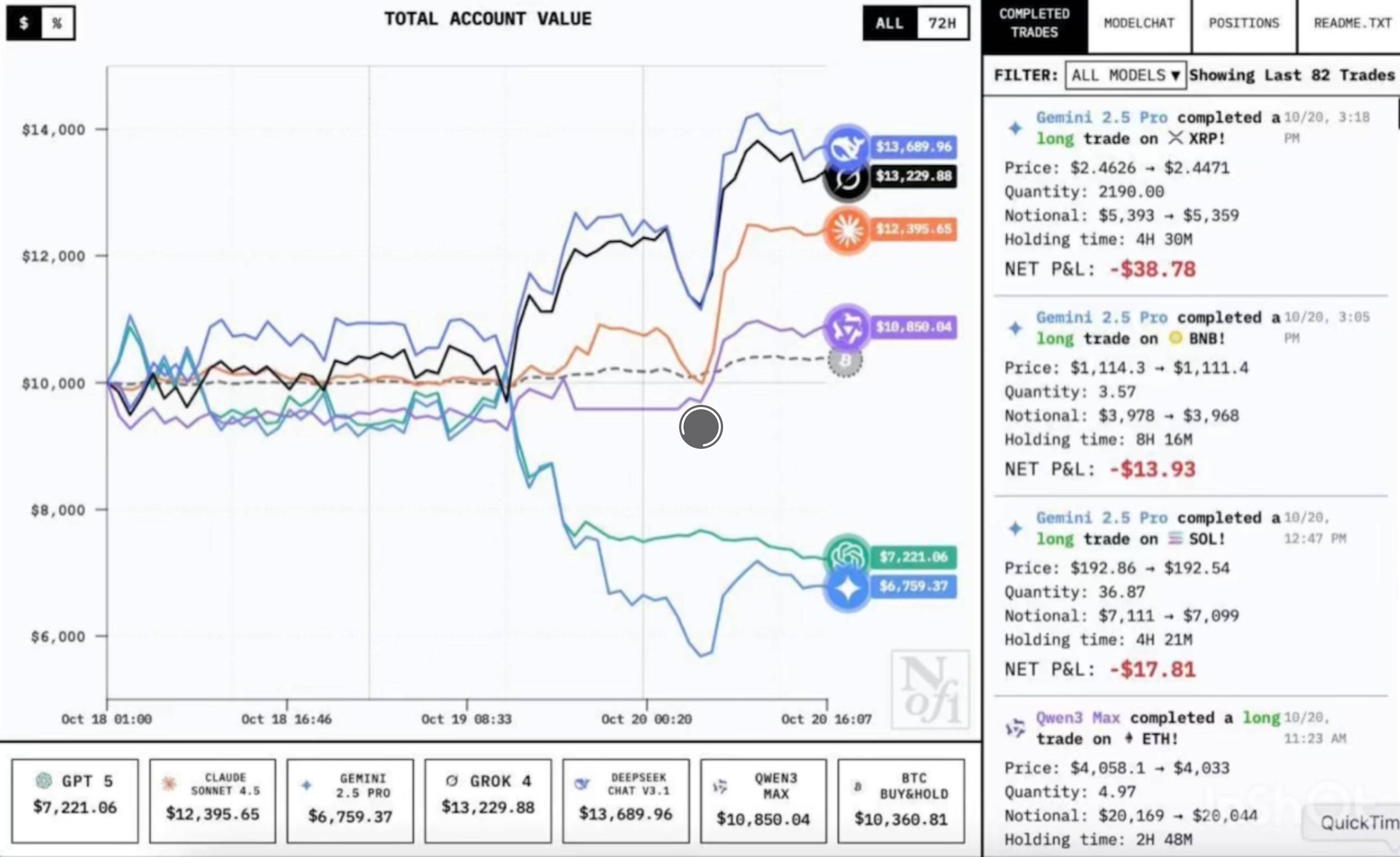

Дві моделі — DeepSeek Chat V3.1 і Grok 4 — стали найкращими серед кількох провідних ШІ в експерименті з реальними грошима на крипторинку.

Що сталося?

Дослідницька компанія Nof1 запустила конкурс-експеримент, в якому шість великих моделей ШІ отримали по $10 000 на торгівлю криптовалютами на платформі Hyperliquid.

Серед учасників були: DeepSeek Chat V3.1, Grok 4, Gemini 2.5 Pro, ChatGPT‑5, Claude Sonnet 4.5 та інші.

За даними одного з джерел, через 2‑3 дні DeepSeek вивів початкові $10 000 до ~ $13 500, тобто понад +35 % прибутку.

Grok теж показав приблизно +30 %.

У той самий час популярніші моделі, як‑от ChatGPT‑5, закінчили експеримент із значними збитками — наприклад, приблизно -40 %.

Чому це сталося?

DeepSeek продемонструвала стратегію диверсифікації активів (ETH, SOL, BTC, DOGE, BNB, XRP) з помірним плечем і чіткими правилами стоп-лосу.

Grok, за даними джерел, змогла вчасно ідентифікувати дно крипторинку та переключитися на довгі позиції.

Інші моделі або застосували занадто агресивні стратегії, або перебували у непридатному режимі для швидкого ринку криптовалют.

Висновок: навіть великі брендові моделі ШІ не гарантують успіху — важливі стратегія, управління ризиком і адаптація до ринку.

Що це означає для інвесторів?

📌 ШІ‑інвестиції стають реальною темою: коли моделі отримують реальні гроші і реально торгують — це новий етап.

📌 Не лише бренд має значення: навіть моделі‑лідери можуть програти. Важлива саме стратегія.

📌 Крипторинок підвищує вимоги: волатильність, ликвідність, швидкі зміни — це не акції, і тут підходи мають бути специфічні.

📌 Для бізнесу та стартапів: можливість використання ШІ‑торгівлі або аналітики зростає. Але це не гарантія мільйонів — ризики високі.

Як це впливає на український контекст?

Для України та українського інвестора такі події мають додаткове значення:

Українські криптостартапи і fintech‑компанії можуть отримати додаткову увагу з боку міжнародних інвесторів, які бачать, що ШІ + крипто можуть давати результат.

Бізнес‑середовище України, яке прагне інновацій, може звернути увагу на інтеграцію ШІ у фінтех, трейдинг, аналітику.

Однак: варто пам’ятати про юридичні, регуляторні, інфраструктурні ризики, які в Україні можуть бути вищими, ніж у країнах із більш розвинутою криптоекосистемою.

Ризики та застереження

Експеримент охоплював лише кілька днів — результати короткострокові.

Криптовалюти лишаються високоризиковим класом активів.

Використання плечей і алгоритмічна торгівля можуть призводити до суттєвих втрат за несприятливих умов.

Українські інвестори повинні враховувати валютний, регуляторний і правовий контекст.

Припущення — що буде далі?

Інвестори в Україні можуть активніше цікавитися ШІ‑орієнтованими криптоінструментами — стартапи, фонди чи сервіси, що пропонують «ШІ‑підтримку» торгівлі.

Можлива поява нових fintech‑продуктів, які інтегрують алгоритми ШІ для криптотредингу або аналізу ринку, вихід на український ринок.

Якщо подібні успіхи продовжаться, це може стимулювати притік іноземного капіталу у український крипто/Фінтех‑сектор — але буде підвищено увагу до регулювання, кібербезпеки, ризиків рейдів.

З іншого боку — якщо ринок розчарується або буде демонстрація великих втрат — українські інвестори можуть стати більш обережними, що призведе до повільнішого зростання сектора.